5 Google Trends to Look Out for in 2022

Reputation Staff Writer

On February 1, Google’s parent company Alphabet reported fourth-quarter earnings that exceeded analysts’ estimates. This sent its stock value to an all-time high — Google had a lot to do with that.

The company’s quarterly ad revenues surged 33% for the quarter. Its revenue from cloud services grew 45%. Alphabet CEO Sundar Pichai said that Google saw an “all-times sales record” for its Pixel smartphone despite supply chain constraints.

The company faces challenges, too, including a growing Big Tech backlash. In the context of a constantly changing industry, how will Google itself evolve in 2022? Here are five predictions.

1. Google Will Lead Online Advertising – But Not Dominate

Google has bounced back (and then some) from a slump that hit its online advertising revenue in 2020. As a result, the search engine continues to hold a leading share of the online advertising industry, over Meta and Amazon Advertising.

In 2022, Google will get an assist from Apple. Because of Apple’s privacy controls enacted in 2021, Meta recently announced that its advertising business would suffer a $10 billion hit in 2022. Google is beyond the reach of Apple’s privacy measures.

But Google won’t dominate the industry the way it once did. Why? Amazon. For the first time, Amazon recently shared its advertising revenues in its quarterly earnings.

The results underscore the threat Amazon poses: $31 billion in revenue, up 33 percent. That’s $31 billion that would have probably gone to Google 10 years ago.

Related: How to Remove Google Reviews: Management of Bad Feedback

Amazon Advertising has figured out how to tap into all its first-party customer search and purchase data and sell highly targeted advertising. Neither Apple nor Google’s own privacy measures can touch Amazon. Google will also face more competition from other retailers that are following Amazon’s lead and creating their own advertising businesses.

2. Google Will Level Up Its E-Commerce Game

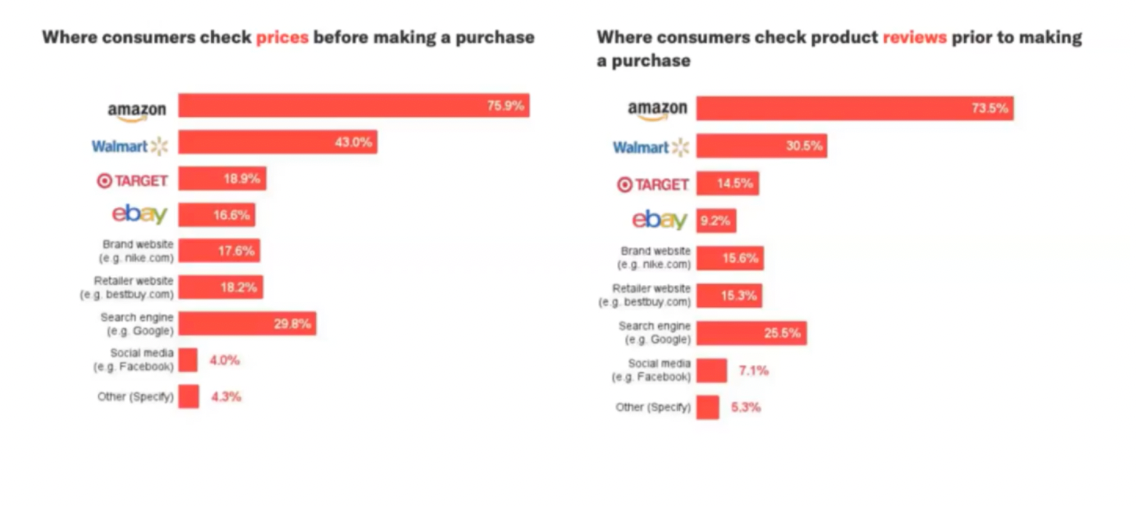

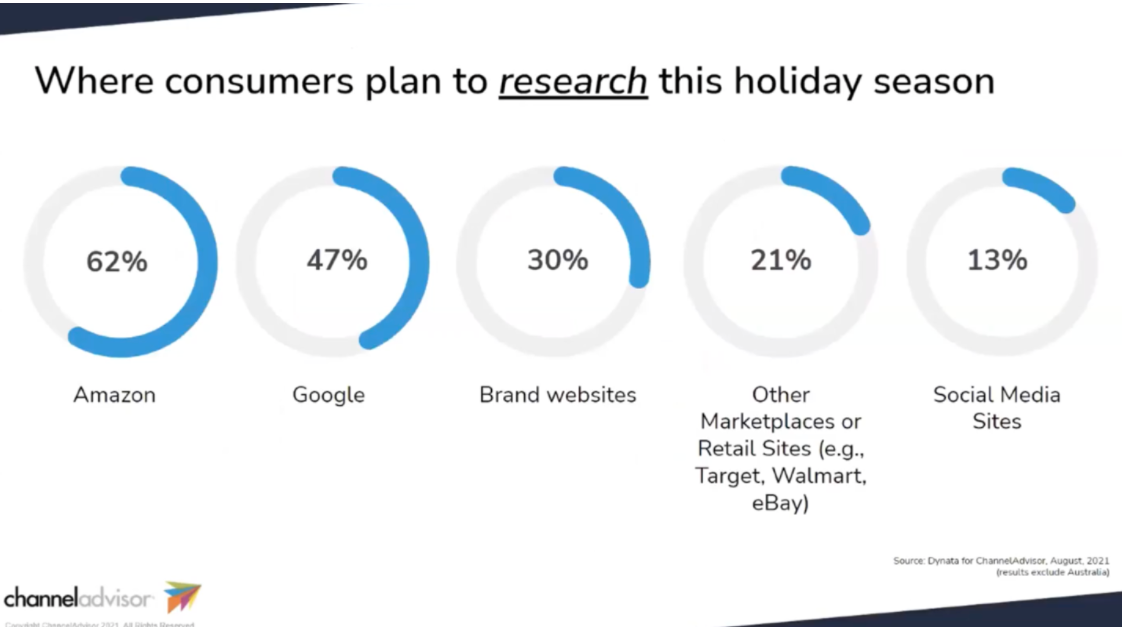

Amazon is a challenger to Google in another important area: product search. Study after study shows that Google lags behind Amazon for product searches:

Consumers do everything from checking prices to product reviews on Amazon and Walmart ahead of Google. When people go to Amazon to search, they tend to buy on Amazon. This is a problem for Google. Not only is Amazon gaining revenue at Google’s expense, but, Amazon is also threatening Google’s dominance of ad spend.

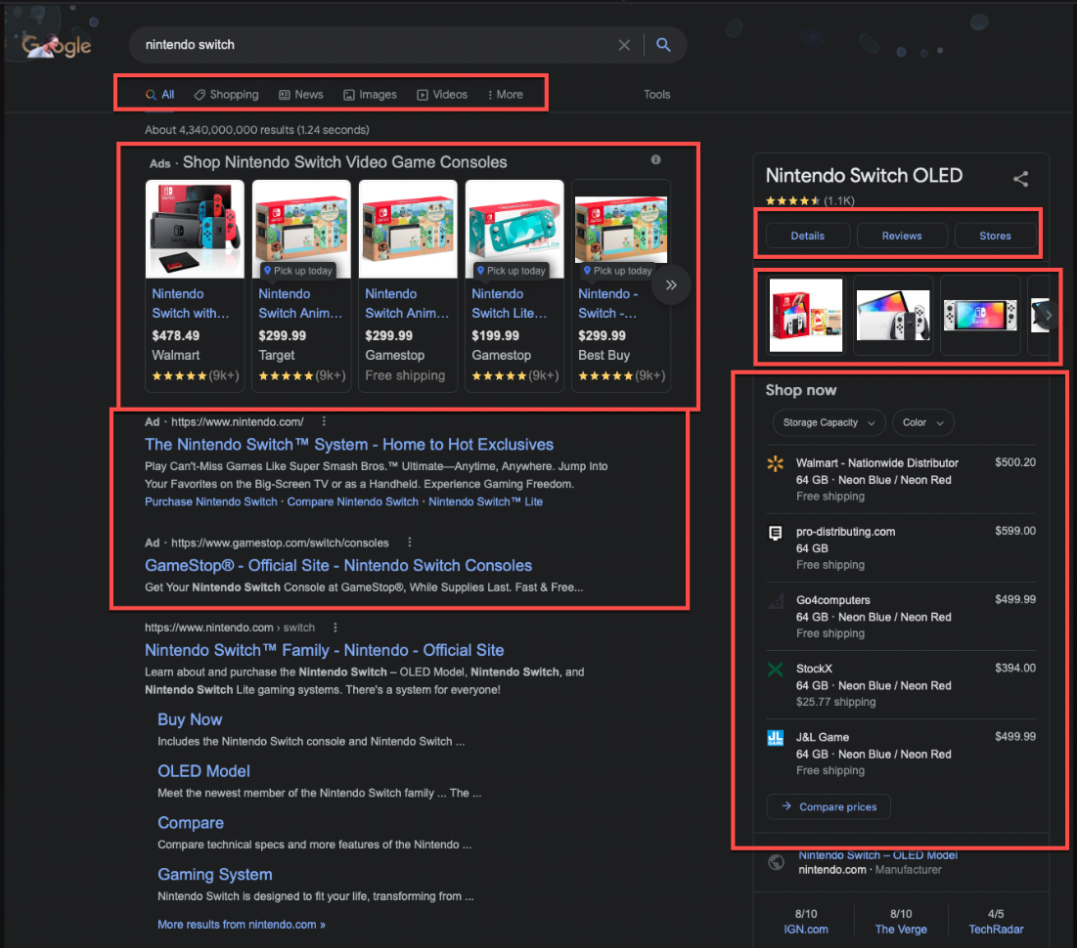

I recently examined how Google is trying to monetize product searches to return results that encourage you to shop on Google. For example, if you search for a Nintendo Switch, you’ll see that Google emphasizes results that either take you to:

- An ad for the product from a Google Ads customer.

- A location on Google Maps to purchase the product.

- Destinations to buy the product online.

- Product reviews.

- Related products to buy.

Everything outlined in red below is either:

- A link that Google makes money on when clicked.

- A link that takes you to results that also exist on a Google-owned property.

Look at how much real estate Google is devoting to results that keep people in Google’s ecosystem. Notice how much Google is showing inventory front and center – what you can buy right now and for how much. I’m also fascinated by how Google features in-store availability for product searches by tapping into Google Map results based on where the searcher is located.

Related: Why Your Business Needs Multiple Google Business Profiles

Google is connecting the dots between product search, your location, and purchase and can make it easier for you to drive to a store and see the product in person. As Amazon does not have product inventory, Google will press this advantage.

3. Google Will Begin to Monetize the Unpublished Web

Google has access to everything we choose to share online on web pages. This ranges from PDF documents to what we share on our websites to the things that people search for every day. That’s the published web.

We know Google has monetized that data effectively through advertising. But we share many interactions with customers and each other in the unpublished web, or data that is behind the firewall. Examples include:

- Messaging through Google Business Messenger or Google chat.

- Surveys and phone calls.

Google is figuring out how to build features for businesses that capitalize on the unpublished web. For example, Google is putting a significant amount of effort to invest in Business Messages. This feature gives businesses a way to have rich, asynchronous messaging experiences across Google, ranging from Search to Google Maps.

This feature can potentially turn traditional cost centers, such as customer contact desks, into revenue generators. When people interact with an enterprise via Business Messages, they’re likely in the process of searching for something to buy. In other words, they create something akin to search data.

Google is also making it possible for businesses to track data about phone calls that result from clicks on Google Business Profiles. Through a feature that is in beta right now, a business can now ask Google to provide a dynamic call tracking number on its Google Business Profile. If a business chooses to do that, it can get more in-depth information on calls that people make via Profiles, such as volume of calls and what happens after people call. Is the phone being picked up? Is the call going to voice? How long do follow-up conversations happen?

As we see adoption and usage of features such as messaging, Google will start to charge money for its use. For example, Google might charge to enable the feature. Then, they may offer a free and for-fee model, put a cap on dynamic call tracking data and for free, and create more features. This will be a new revenue stream.

Related: How Google Might Collect Customer Reviews In the Future

4. Google Will Leverage Devices to Grow Faster into Healthcare

Google is a purpose-driven brand. Although the company is beholden to its shareholders, Google spends a lot of resources on initiatives to go beyond driving up its stock price. Healthcare is one example. During Covid-19, Google moved mountains to protect public health, such as new features and attributes on Google Business Profiles and search results to help healthcare providers share critical information about where to get vaccines and tested.

Google, like Apple, has an advantage in personal healthcare: a data platform tied to devices. For instance, Google Fit is a health-tracking platform for the Android operating system, Wear OS and Apple Inc.’s iOS. It is a single set of APIs that blends data from multiple apps and devices. With Google Fit, you can connect any Android-enabled device such as a Garman Watch to collect health information in one place.

Hardware, though, is the key to Google’s foray into health. Devices, ranging from Chromebooks to Pixel phones to home devices, provide the pipes for Google users to manage their personal data and for Google to monetize it.

Meta, by contrast, lacks its own device, and for that reason is beholden to Google and Apple. Devices will power Google’s future in healthcare and I believe Google will press its advantage and acquire another device manufacturer as it did many months ago with Fitbit. Because when you own the devices and the hardware, you can gather even more information and monetize it.

5. Google Will Make More Concessions in the Privacy and Trust Wars

Google made headlines in 2020 when the company said it would phase out third-party cookies on its browser Google Chrome, the world’s most popular browser by a wide margin. This was big news because advertisers rely on third-party cookies to track user behavior across the web in order to serve up personalized ads. Google said it would work with advertisers to create alternatives to third-party cookies through its Privacy Sandbox.

But things have not quite turned out the way Google had hoped. In 2021, the United Kingdom’s Competition and Markets Authority (CMA) announced it was investigating Google’s Privacy Sandbox for potential violation of antitrust laws.

Related: Why Google Business Profiles and Reviews Power Local Search

Under pressure from the CMA, Google delayed its phasing out of third-party cookies until 2023. In 2022, Google walked back one of its consumer privacy initiatives, an alternative to third-party cookies known as FLoC (Federated Learning of Cohorts). Google replaced FLoCs with a new project, Google Topics.

Google is going to continue to experience pushback from governments around the world. This is partly a result of growing anti-Big Tech sentiment overall, but it’s also a result of Google’s success. Expect Google to proceed cautiously in 2022.

Wrapping it Up

I’ve barely scratched the surface in this post, and the fact of the matter is that Google is one of the most powerful companies in the world. Google will continue to grow and evolve. It will be interesting to see where they branch out to in the next year, and I’m excited to see what surprises I wasn’t expecting they have in store for us.

Keep Reading: What is a Google Business Profile?