2018 Retail Reputation Report

Reputation Staff Writer

Executive Summary

Why This Report Matters

The 2018 Retail Reputation Report gives in-store retailers systematic insights into their strengths and opportunities for operational improvement, based on online consumer reviews.

This report reveals – in a way no survey technology can – which retailers lead and lag on key dimensions of the shopping experience as expressed in the spontaneous, unfiltered voice of the customer in reviews on Google, social media and across the web.

The report has significant business implications for retailers. We found a strong correlation between a chain’s Reputation Score – an industry index of visibility and customer sentiment on the web – and retail store sales growth.

How We Analyzed Retail Experience

We applied machine learning and sentiment analysis to unstructured text from 4.7 million consumer reviews that were posted on Google and Facebook. The reviews cover in-store shopping experiences at nearly 30,000 locations owned by 88 marquee retail chains in the United States, United Kingdom and European Union.

Our algorithms structured the free text from consumer reviews into nine key in-store experience customer experience (CX) categories: value, service, wait time, cleanliness, convenience, manager interactions, product availability, staff competence, and facilities including parking and amenities.

Retailers included in this year’s report ranged from big-box discounters like Costco, to hardware merchants Lowe’s and The Home Depot, to high-end boutiques like Gucci and Tiffany & Co.

What’s Your Reputation Score?

Measured on a scale of one to 1,000, Reputation Score is a comprehensive index of a company’s digital presence and on-site customer experience. It is calculated based on factors that include review sentiment, volume, recency, spread across review sites, social media sentiment, business listings accuracy and other factors that unambiguously reflect consumers’ opinions about their search and in-store experience.

Store Revenue Is Tied to Reputation Score

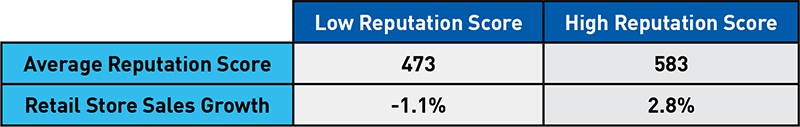

Our analysis of a cohort of 48 of the major retailers in this study for which revenue data was publicly available* reveals that chains with a high Reputation Score generated year-over-year store sales growth of 2.8 percent.

On the other hand, retailers that aren’t effectively managing their online reputations and had low Reputation Scores saw store sales decline, on average by 1.1 percent.

This amounts to a 3.9 percent difference in revenue for the retailers with high Reputation Scores – a significant impact on total store sales.

The Retail Reputation Leaders for 2018

The Retail Reputation Leaders for 2018

The industry-average Reputation Score for retailers in 2018 was 538 on a scale of 1,000.

The retailers most trusted by consumers to deliver a great overall customer experience are:

| Rank | Retailer | Rating |

| 1 | The LEGO Store | 695 |

| 2 | Trader Joe’s | 690 |

| 3 | Nordstrom | 673 |

| 4 | Wegmans | 664 |

| 5 | Barnes & Noble | 663 |

| 6 | REI | 663 |

| 7 | Disney Store | 662 |

| 8 | Publix | 662 |

| 9 | Costco | 658 |

| 10 | Hobby Lobby | 655 |

| 11 | Bass Pro Shops | 654 |

| 12 | Michaels | 626 |

| 13 | Ace Hardware | 615 |

| 14 | L.L. Bean | 606 |

| 15 | Victoria’s Secret | 602 |

| 16 | Nordstrom Rack | 601 |

| 17 | TJ Maxx | 599 |

| 18 | PetSmart | 598 |

| 19 | IKEA | 596 |

| 20 | Cabela’s | 594 |

| 21 | Neiman Marcus | 593 |

| 22 | Nike | 590 |

| 23 | John Lewis | 589 |

| 24 | Whole Foods | 585 |

| 25 | Tiffany & Co. | 584 |

It’s notable that excellence in customer experience was demonstrated by such a wide range of players. In contrast to last year’s report, when toy and baby stores earned four of the top 10 slots, no single retail segment dominates the rankings this year. Retailers can lead in consumer sentiment from any category.

Notably, however, even the leaders have reason to monitor consumer reviews for warning signs. Disney Store, for instance, declined one-half star in consumers’ assessment on wait time and manager competence. Consumers dinged IKEA on wait time, service and product in-stock.

Consumer reviews are early-warning signals that leading retailers should heed as they tune operations for the holidays.

About Reputation.com

Reputation.com, Inc., based in Silicon Valley, pioneered online reputation management (ORM) technology for the enterprise market in 2006. With its SaaS platform, businesses across the Americas, Europe and Asia Pacific gain actionable insights that help them make operational changes, improve online reputation and drive revenue.

Reputation.com technology has managed tens of millions of consumer reviews and consumer interactions across hundreds of thousands of online points of presence for global companies spanning 77 industry verticals.

Dr. Brad Null

Chief Scientist, Reputation.com

Consumers Are Talking. Are Retailers Listening?

Google reports that searches for “shopping near me” have grown over 200 percent in the last two years alone. Because star ratings are featured prominently on search results – both in browsers and on maps– they’re a critical factor driving consumers’ choices.

Shoppers making plans to get out and rub shoulders with the crowds are sharing their experiences with the world. The data we’ve captured from consumer reviews reveals important trends by category that retailers need to monitor, learn from, and act on.

Apparel

Anyone looking for outstanding service can count on it from industry leader L.L. Bean, rated 4.5 stars. Most apparel retailers hover around a commendable 4 stars. Ralph Lauren was most-improved, rising to 3.5 from 2.2 stars in 2017. Shoppers in a hurry should drop by Express (4.1) or Aeropostale (4.0).

Children’s Apparel and Toys

Extending its leadership in the category at 695 points, The LEGO Store notched the highest Reputation Score in our sample.

OshKosh B’Gosh registered the greatest improvement in overall ratings over last year, rising from 3.7 stars to 4.4, with particularly strong performances in value, service and staff competence.

Department Stores

Consumers are notably happy in their reviews of department stores. Macy’s, Kohl’s, J.C. Penney, H&M, Marks & Spencer, Next PLC and Debenhams all hover close to 4 stars.

Shoppers report the best service experience at British retailers, which as a group eclipsed American chains. John Lewis rated 4.4 stars; Marks & Spencer, Next PLC and Debenhams earned 4.3. The American chains were all lower.

Electronics

Staff competence at Best Buy (4.3) is judged by shoppers to be the strongest we studied, notching significant improvements over last year for value and wait times.

Grocery

Trader Joe’s Reputation Score at 690 eclipsed every other grocery chain — outscoring the entire field on value, service and wait time, as well as manager and staff competence. In general, the rest of the field was challenged, with lagging performance and year-over-year declines in value, service, cleanliness, manager competence, staff, product in-stock and amenities.

Health and Beauty

The fairest of them all in this category is Ulta, with a Reputation Score of 549. The beauty chain made improvements over last year in all nine categories of service experience we extracted from customer reviews. The rest of the field’s star ratings were flat to declining versus last year.

Housewares

IKEA led the field in Reputation Score at 596 and with a 4.3-star average rating, followed closely by Bed Bath & Beyond at 566 (and tying for 4.3 stars). Both chains are decisively ahead on value, but have opportunities for improvement in other dimensions.

Luxury Brands

Tiffany & Co. eclipsed the field with a Reputation Score of 584, with particularly high ratings in service (4.4). Signet Jewelers, while notching a lower Reputation Score, has clearly focused on CX across the board, registering year-over-year improvements in value, service, wait time, cleanliness and manager competence.

Sporting Goods

Bass Pro Shops leads decisively in this category with a Reputation Score of 654, followed by Cabela’s (594) and Nike (590). Shoppers experience the best service at Nike, Cabela’s and Under Armour (each earning 4.2 stars). The lines are shorter at Nike (3.4) than Foot Locker (3.1) and Cabela’s (2.5).

Which Retailers Lead Customer Experience Across Categories?

Looking across all retail categories, our algorithms analyzed nearly 30,000 locations and 4.7 million consumer reviews. The star ratings that follow reveal which retailers are leading on the nine dimensions of customer experience in this study: value, service, wait time, cleanliness, convenience, management, product in-stock, staff and facilities (including parking and amenities).

1) Value: Where the Deals Are

The Value Leaders

| Rank | Retailer | Rating |

| 1 | Trader Joe’s | 4.7 |

| 2 | Costco | 4.5 |

| 3 | OshKosh B’Gosh | 4.5 |

| 4 | Wegmans | 4.4 |

| 5 | Carter’s | 4.4 |

| 6 | Ross Dress for Less | 4.3 |

| 7 | TJ Maxx | 4.3 |

| 8 | Hobby Lobby | 4.3 |

| 9 | Aeropostale | 4.3 |

| 10 | GAP | 4.2 |

| 11 | IKEA | 4.3 |

| 12 | Dollar General | 4.2 |

| 13 | Coach | 4.2 |

| 14 | Under Armour | 4.2 |

| 15 | H&M | 4.2 |

| 16 | Michaels | 4.2 |

| 17 | Ralph Lauren | 4.2 |

| 18 | The LEGO Store | 4.2 |

| 19 | Adidas | 4.2 |

| 20 | Burlington | 4.1 |

| 21 | Chico’s | 4.1 |

| 22 | Nike | 4.1 |

| 23 | Michael Kors | 4.1 |

| 24 | Ace Hardware | 4.1 |

| 25 | Gymboree | 4.1 |

Beyond the two price leaders you’d expect to see at the top of the list, surprise winners were OshKosh B’Gosh and Carter’s in the baby category, as well as fashion emporia Coach, Ralph Lauren and Michael Kors comprising the top 25 among all retailers assessed by consumers.

Shoppers credited some merchants for improving significantly on value over last year – specifically, Signet Jewelers (which rose from 1.9 stars to 2.6), Sears (2.9 to 3.5), Lowe’s (3.1 to 3.6), and interestingly, Gucci (2.9 to 3.5).

2) Help! I Need Somebody…

The Service Leader

| Rank | Retailer | Rating |

| 1 | The LEGO Store | 4.7 |

| 2 | Trader Joe’s | 4.7 |

| 3 | Ace Hardware | 4.6 |

| 4 | REI | 4.6 |

| 5 | Barnes & Noble | 4.6 |

| 6 | Wegmans | 4.6 |

| 7 | Publix | 4.5 |

| 8 | Disney Store | 4.5 |

| 9 | L.L. Bean | 4.5 |

| 10 | OshKosh B’Gosh | 4.4 |

| 11 | Hobby Lobby | 4.4 |

| 12 | Tiffany & Co. | 4.4 |

| 13 | Bed Bath & Beyond | 4.4 |

| 14 | Costco | 4.4 |

| 15 | John Lewis | 4.4 |

| 16 | Michaels | 4.4 |

| 17 | Marks & Spencer | 4.3 |

| 18 | Next PLC | 4.3 |

| 19 | Coach | 4.3 |

| 20 | PetSmart | 4.3 |

| 21 | Debenhams | 4.3 |

| 22 | Bass Pro Shops | 4.3 |

| 23 | New Loo | 4.3 |

| 24 | Carter’s | 4.2 |

| 25 | Chico’s | 4.2 |

The LEGO Store and Trader Joe’s won consumers’ affection hands-down for service, scoring 4.7 stars and edging past last year’s winner, Disney Store.

Notably – perhaps because e-commerce alternatives have focused the minds of the brick-and-mortar world on service as the fundamental differentiator – the top 50 retailers all scored 4.0 or better on service.

3) Wait for It…

The Wait-Time Leaders

| Rank | Retailer | Rating |

| 1 | Trader Joe’s | 4.5 |

| 2 | Wegmans | 4.4 |

| 3 | Ace Hardware | 4.3 |

| 4 | Costco | 4.1 |

| 5 | Express | 4.1 |

| 6 | Aeropostale | 4.0 |

| 7 | Barnes & Noble | 3.8 |

| 8 | Dillard’s | 3.7 |

| 9 | Kohl’s | 3.7 |

| 10 | L.L. Bean | 3.7 |

| 11 | REI | 3.7 |

| 12 | Marks & Spencer | 3.6 |

| 13 | Debenhams | 3.6 |

| 14 | Nordstrom Rack | 3.6 |

| 15 | Bed Bath & Beyond | 3.6 |

| 16 | Hobby Lobby | 3.6 |

| 17 | Michaels | 3.6 |

| 18 | Target | 3.6 |

| 19 | Whole Foods | 3.5 |

| 20 | Travis Perkins | 3.5 |

| 21 | TJ Maxx | 3.5 |

| 22 | Under Armour | 3.5 |

| 23 | Ralph Lauren | 3.5 |

| 24 | Publix | 3.5 |

| 25 | John Lewis | 3.5 |

By now, you’re detecting a pattern. Trader Joe’s backed up its reputation for service with consumer kudos on wait time. Ace Hardware also led the retail industry in prompt service, improving from 2.9 stars for wait time in 2017 to 4.3 in this year’s results.

U.K. retailer Marks & Spencer performed well here, ranking number 12.

4) Sweeping Up

The Cleanliness Leaders

| Rank | Retailer | Rating |

| 1 | The LEGO Store | 4.7 |

| 2 | Wegmans | 4.7 |

| 3 | Trader Joe’s | 4.7 |

| 4 | Publix | 4.7 |

| 5 | Athleta | 4.7 |

| 6 | L.L. Bean | 4.7 |

| 7 | Costco | 4.6 |

| 8 | Ace Hardware | 4.6 |

| 9 | Hobby Lobby | 4.6 |

| 10 | Barnes & Noble | 4.6 |

| 11 | Carter’s | 4.5 |

| 12 | Gymboree | 4.5 |

| 13 | Disney Store | 4.5 |

| 14 | Bass Pro Shops | 4.5 |

| 15 | REI | 4.5 |

| 16 | Under Armour | 4.5 |

| 17 | Aeropostale | 4.5 |

| 18 | Cabela’s | 4.5 |

| 19 | OshKosh B’Gosh | 4.4 |

| 20 | Nordstrom | 4.4 |

| 21 | Michaels | 4.4 |

| 22 | AT&T Wireless | 4.4 |

| 23 | Gucci | 4.4 |

| 24 | Justice | 4.4 |

| 25 | Kohl’s | 4.4 |

Retailers overall scored well on consumer comments in this most basic of categories, with an industry average of 4.2.

5) Make It Easy

The Convenience Leaders

| Rank | Retailer | Rating |

| 1 | REI | 4.8 |

| 2 | Wegmans | 4.7 |

| 3 | Anthropologie | 4.7 |

| 4 | Trader Joe’s | 4.7 |

| 5 | Disney Store | 4.7 |

| 6 | Barnes & Noble | 4.6 |

| 7 | Abercrombie & Fitch | 4.6 |

| 8 | The LEGO Store | 4.6 |

| 9 | Costco | 4.6 |

| 10 | Publix | 4.6 |

| 11 | Williams-Sonoma | 4.5 |

| 12 | Hollister Co. | 4.5 |

| 13 | Carter’s | 4.5 |

| 14 | Marks & Spencer | 4.5 |

| 15 | Nordstrom | 4.5 |

| 16 | Bed Bath & Beyond | 4.5 |

| 17 | Bass Pro Shops | 4.4 |

| 18 | IKEA | 4.4 |

| 19 | Debenhams | 4.4 |

| 20 | Hobby Lobby | 4.4 |

| 21 | PetSmart | 4.4 |

| 22 | L.L. Bean | 4.4 |

| 23 | Michaels | 4.4 |

| 24 | Cabela’s | 4.4 |

| 25 | American Eagle Outfitters | 4.4 |

Trader Joe’s and Disney Store again appeared at the top of the rankings here, with the latter notching an improvement over 2017 from 4.3 to 4.7 stars. Publix, Bed Bath & Beyond and Staples also saw gains of one-half star or more.

6) Let Me Talk to Your Manager

The Management Leaders

| Rank | Retailer | Rating |

| 1 | The LEGO Store | 4.1 |

| 2 | Trader Joe’s | 3.6 |

| 3 | AT&T Wireless | 3.2 |

| 4 | Bed Bath & Beyond | 3.1 |

| 5 | Michaels | 3.1 |

| 6 | Tiffany & Co. | 3.1 |

| 7 | REI | 3.1 |

| 8 | Debenhams | 3.1 |

| 9 | Dollar General | 3.0 |

| 10 | Wegmans | 2.9 |

| 11 | Signet Jewelers | 2.9 |

| 12 | Publix | 2.9 |

| 13 | Under Armour | 2.9 |

| 14 | Barnes & Noble | 2.8 |

| 15 | Lululemon Athletica | 2.8 |

| 16 | Kohl’s | 2.8 |

| 17 | Burberry | 2.8 |

| 18 | Ace Hardware | 2.8 |

| 19 | Hobby Lobby | 2.6 |

| 20 | J. Crew | 2.6 |

| 21 | Staples | 2.6 |

| 22 | PetSmart | 2.6 |

| 23 | Costco | 2.6 |

| 24 | Dick’s Sporting Goods | 2.5 |

| 25 | Express | 2.5 |

This year’s data shows large swings in customer experience with store management. Our theory is that by the time someone gets to a manager, something has already gone wrong.

While The LEGO Store and Trader Joe’s leadership has clearly had the training to manage and resolve customer issues, rankings drop hard and fast among the rest of the field. Fully 78 percent of the retailers we analyzed score fewer than three stars for management. It’s rough out there.

7) What Do You Mean, You Don’t Have It?

The In-Stock Leaders

| Rank | Retailer | Rating |

| 1 | Wegmans | 4.6 |

| 2 | Trader Joe’s | 4.6 |

| 3 | The LEGO Store | 4.6 |

| 4 | Ace Hardware | 4.6 |

| 5 | Costco | 4.5 |

| 6 | Hobby Lobby | 4.5 |

| 7 | Coach | 4.5 |

| 8 | Barnes & Noble | 4.5 |

| 9 | Publix | 4.5 |

| 10 | REI | 4.5 |

| 11 | Tiffany & Co. | 4.5 |

| 12 | Michael Kors | 4.5 |

| 13 | Chico’s | 4.4 |

| 14 | OshKosh B’Gosh | 4.4 |

| 15 | Carter’s | 4.4 |

| 16 | Travis Perkins | 4.4 |

| 17 | Holland & Barrett | 4.4 |

| 18 | Justice | 4.4 |

| 19 | Bass Pro Shops | 4.4 |

| 20 | Anthropologie | 4.4 |

| 21 | Saks Fifth Avenue | 4.3 |

| 22 | Bed Bath & Beyond | 4.3 |

| 23 | Whole Foods | 4.3 |

| 24 | L.L. Bean | 4.3 |

| 25 | Ralph Lauren | 4.3 |

When rating stores for product availability, consumers are most likely to find what they came for at grocers Wegmans and Trader Joe’s, with The LEGO Store (again) in the medals.

Michael Kors registered the greatest improvement in supply chain and distribution, rising from 4 stars in 2017 to 4.5 stars this year.

8) Who Knows Their Stuff?

The Staff Leaders

| Rank | Retailer | Rating |

| 1 | The LEGO Store | 4.8 |

| 2 | Trader Joe’s | 4.8 |

| 3 | Publix | 4.7 |

| 4 | REI | 4.7 |

| 5 | Ace Hardware | 4.7 |

| 6 | Wegmans | 4.7 |

| 7 | Disney Store | 4.7 |

| 8 | OshKosh B’Gosh | 4.7 |

| 9 | Barnes & Noble | 4.6 |

| 10 | Holland & Barrett | 4.6 |

| 11 | Next PLC | 4.6 |

| 12 | L.L. Bean | 4.6 |

| 13 | Costco | 4.6 |

| 14 | Hobby Lobby | 4.6 |

| 15 | Coach | 4.6 |

| 16 | Carter’s | 4.5 |

| 17 | Chico’s | 4.5 |

| 18 | Bed Bath & Beyond | 4.5 |

| 19 | Gymboree | 4.5 |

| 20 | Marks & Spencer | 4.5 |

| 21 | John Lewis | 4.5 |

| 22 | Athleta | 4.5 |

| 23 | Dollar General | 4.5 |

| 24 | Aeropostale | 4.4 |

| 25 | PetSmart | 4.4 |

The industry as a whole scored very well on staff competence.

The most improved retailer on this dimension? Aeropostale, which rose from 3.7 stars in 2017 to 4.4 this year. All of the retailers in this study scored 3.5 stars or better on staff competence, suggesting they’re making ongoing investments in training.

9) Shopping, Shopping Everywhere and Not a Place to Park

The Facilities Leaders

| Rank | Retailer | Rating |

| 1 | The LEGO Store | 4.9 |

| 2 | Wegmans | 4.4 |

| 3 | Crate & Barre | 4.3 |

| 4 | Under Armour | 4.3 |

| 5 | Cabela’s | 4.3 |

| 6 | Ace Hardware | 4.3 |

| 7 | Saks Fifth Avenue | 4.3 |

| 8 | Bed Bath & Beyond | 4.3 |

| 9 | John Lewis | 4.3 |

| 10 | Trader Joe’s | 4.3 |

| 11 | Coach | 4.3 |

| 12 | Nordstrom | 4.3 |

| 13 | Hugo Boss | 4.3 |

| 14 | L.L. Bean | 4.3 |

| 15 | Anthropologie | 4.2 |

| 16 | Marks & Spencer | 4.2 |

| 17 | Kohl’s | 4.2 |

| 18 | Abercrombie & Fitch | 4.2 |

| 19 | Publix | 4.2 |

| 20 | Bass Pro Shops | 4.2 |

| 21 | Victoria’s Secret | 4.2 |

| 22 | Barnes & Noble | 4.1 |

| 23 | REI | 4.1 |

| 24 | Hobby Lobby | 4.1 |

| 25 | IKEA | 4.1 |

The LEGO Store led the field again with 4.9-star average reviews for parking, facilities and amenities.

Big gains on this dimension were scored by Under Armour, which rose from 3.6 to 4.3 stars this year, and Bed Bath & Beyond (3.8 to 4.3).

Conclusion

Consumers are living and shopping in an age of nearperfect transparency now, as they post and read reviews about the service they’re receiving at retailers.

The perfect shopping experience, far from being a matter of chance, happens when a retailer fully understands – and has the information to fully manage – every facet of the consumer’s journey, from the web to the four walls.

Retailers have an important opportunity to capture the data available to them in the vast ocean of unstructured consumer feedback on the web, and put it to work to improve customer experience and attract more customers to their stores.

Methodology Note:

This analysis was applied to 4.7 million consumer reviews of 27,660 locations for 88 marquee retailers posted on Google and Facebook between October 1, 2016 and October 31, 2018.

The star ratings in this report represent the average ratings from reviews with written comments that could be analyzed for the nine specific aspects of consumer experience extracted from free text.

Note: Scores for retailers included in the 2017 edition of this report vary from this year’s findings because the data extraction was extended to a larger number of stores for those retailers. The net effect is that both 2017 and 2018 scores are more accurate.

The Retail Reputation Leaders for 2018

The Retail Reputation Leaders for 2018