Online Reputation Management for Financial Service Firms

Reputation Staff Writer

After the 2008 crash that resulted in a recession, the financial services industry has been faced with a torrent of negative public perception.

Online reputation presents a huge opportunity to financial services firms as they seek to change how they’re perceived by the public. If you’re expecting people to trust your organization with their finances and investments, shouldn’t your organization be reliable and trustworthy?

Brand loyalty is a rare thing for financial institutions. That’s because consumers usually look for firms that offer the most secure investments and are seen as trustworthy. That’s where online reputation comes into play.

What Is Online Reputation Management?

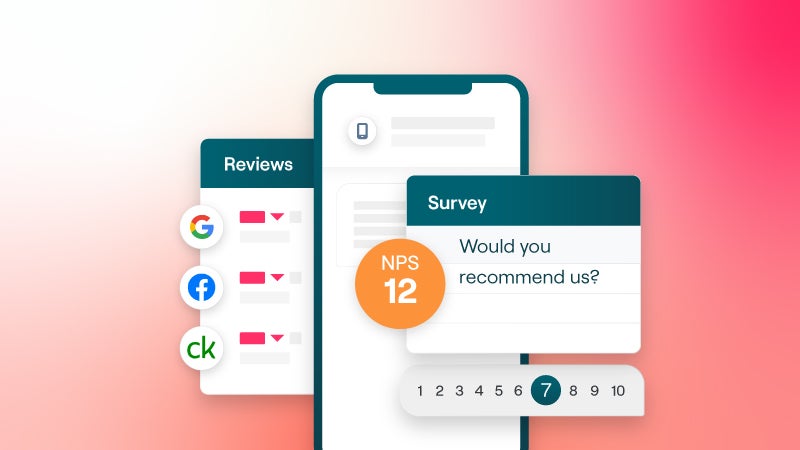

Online Reputation Management (ORM) is the practice of engaging with the community of people who use a search engine to find and engage with your business online. A strong ORM program ensures that online business listings are accurate. That way, people can find you. It also enables you to harness the power of the digital conversations about you to improve your online reputation.

ORM has three elements:

- Ensuring your business gets found by improving your performance in online search.

- Encouraging customers reviews and responding to them so that your brand will get chosen by consumers who do thorough research.

- Taking action on customer feedback to improve business operations and get better.

Done right, online reputation management can help retain existing clients and attract potential new ones. It sets you apart from other financial service providers in the market. It can also benefit your financial business in a number of ways.

But it’s important to remember that online reputation management should be performed alongside other best business practices. After all, it’ll be hard to maintain your reputation if you’re not giving customers the best experience possible.

Why Is Online Reputation Management Important?

With many relying on internet for information about where to spend or bank their money, customer feedback matters more than ever. For financial services firms, ORM can drive traffic to locations, increasing revenue, while bringing additional benefits:

Related: Your Financial Services Firm’s Reputation May Be on the Line

Improves Search Engine Optimization (SEO) for better rankings: If someone were to search for a bank branch or certified financial planner, what would they see online? Google now ranks largely on customer reviews. That means if your potential client were to search for “bank near me,” the results depend largely on what customers say about you online. Building review volume by proactively requesting feedback and reviews from all customers helps firms present a fair representation of the services they provide online.

Improves customer sentiment by consistently responding to reviews: Best practice is to respond to 100 percent of negative reviews and 60 percent of positive reviews. Using ORM technology, organizations can respond directly to reviews in their native source.

Enables effective community engagement: In a sector as fast-paced as financial services, community management can be difficult to build and maintain. ORM enables firms to monitor and publish relevant content to social media channels at the local level. This will build community engagement close to locations.

Provides a single source of truth: ORM makes it easier to maintain overall control of how your brand is perceived in the public eye by pulling data from all online sources into a single platform.

What Are the Elements of Online Reputation Management?

Online reputation management does not happen by magic. Financial services firms need to take ownership of the process as follows:

Related: 6 Stats that Highlight the Importance of Reputation Management in Finance

Getting Found

Audit all the places people learn about your business and make sure that your content is optimized for search. We recommend focusing on your website, your Google Business Profile listings, Facebook, and a few vertical-specific review sites. A Profile is an important jumping off point for people to learn about your business. Financial Services firms need to turn their GBP listings into content powerhouses, with customer Q&As and descriptive content about their services.

Getting Chosen

Financial services companies need to accumulate positive customer ratings and reviews everywhere home buyers find them – on their websites, social media platforms, and on their GBP listings.

But how do you get positive reviews? You ask for them. Of course, don’t ask for a positive review — that’s a big no-no. Just ask for the review, either in person, email, or the communication method of your choice.

From there, monitor your reviews on locations such as your GBP listing and your Facebook business page. Beyond that, you should find out if you’re listed on any third-party websites that review financial services.

If you encounter a negative review, don’t just hide or remove it unless it’s against policy or guidelines. Hiding feedback will have a more significant negative impact on your reputation more than the feedback itself.

The best action is to reply to the negative review sincerely and calmly. Let the customer know you sympathize with their experience and genuinely want to improve the situation. You’ll be viewed as more professional and caring towards your clients, despite the negative feedback.

Related: Why Online Reputation Management Matters to Mortgage Lenders

Then, try to move the conversation to a private channel as soon as you can. This allows you to find a solution or resolution to the customer’s complaint much faster.

But the most effective long-term solution for bad reviews is counteracting them with positive ones. Encourage your customers to leave you reviews, especially if they are happy with your services.

Getting Better

Learn from reviews. By monitoring reviews, collecting feedback, and analyzing that data, you can uncover patterns in responses. This may include people complaining about a consistently subpar response time at one of your branches. Your branches can also learn from each other by analyzing patterns of positive reviews from one branch to the next.

Doing all this requires synthesizing large amounts of customer data, both structured and unstructured. This is why businesses are increasingly turning to artificial intelligence to scan vast amounts of data and report it. Reputation offers a software platform to help businesses ask for reviews, respond to them, and learn from them. Our platform uses forms of artificial intelligence such as natural language processing to find those crucial patterns hiding in customer feedback.

Online reputation management for personal financial advisors and firms is a discipline that you can take on easily — step by step. Contact Reputation to learn more.