How to Turn Patients into Digital Advocates

Reputation Staff Writer

Executive Summary

- Meet the new healthcare consumer

The consumerization of healthcare, major demographic shifts, and the migration to mobile and social media are tilting the balance of power away from traditional healthcare marketers and into the hands of potential patients. Patient engagement is on the rise. - Online reputation is the new competitive frontier for marketers

Healthcare brands are no longer controlled by marketers. Patient feedback about doctors and facilities online is leading to total market transparency for healthcare consumers. CG-CAHPS surveys only go so far in providing social proof. - Healthcare branding is becoming hyper-local

In the search for providers, all branding is local – at the level of individual practitioners and facilities. Proliferating points of presence on the web make this a challenge that requires technology. But healthcare marketers who scale online review volume and quality will be rewarded with higher search visibility. - Business implications

Online ratings and reviews stand between everything a healthcare organization spends on marketing and its revenue performance.

Online ratings and reviews stand between everything a healthcare organization spends on marketing and its revenue performance. - A plan for action

Monitoring and requesting authentic reviews and enlisting social communities to share their positive experiences has paid huge dividends for leading healthcare organizations.

1. Meet the New Healthcare Consumer

Major demographic shifts and the migration to mobile and social media are tilting the balance of power away from traditional healthcare marketers and into the hands of potential patients. Patient engagement is on the rise.

The Consumerization of Healthcare

Patients are no longer passive consumers of care. Marketers must account for a new kind of healthcare buyer. Larger co-pays are motivating potential patients to shop around, and copious information about alternatives is giving them unprecedented power to do so.

Boomer Bust

Demographics are Changing

For decades, healthcare marketing has focused on boomers, meeting them in the media they’re accustomed to, largely through advertising. This used to be a sound strategy. But the landscape has changed: The boomer population has declined to only one-fourth of U.S. population. Millennials now outnumber boomers as a share of the healthcare market.1

And the shift will accelerate, as millennials rise to be one-third of U.S. healthcare consumers within four years.2 This means that to be successful in the immediate future, healthcare marketers must develop better strategies to reach them. They must focus on patient engagement.

The Shift to Mobile

On top of these dynamics, the dominant marketing channel has changed from monolithic mass media to social micro-casting on mobile devices.

An Aggressive Shift to Mobile

Millennials Want Social Proof

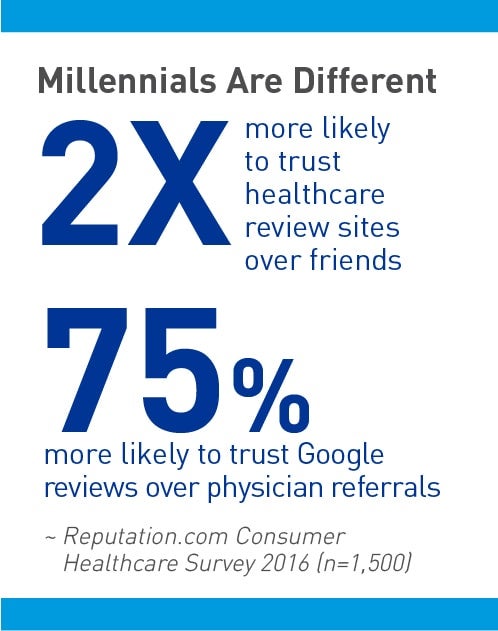

An extensive survey of 1,500 representative U.S. healthcare consumers conducted by Reputation.com in 2016 demonstrates the unprecedented influence of web media on how a rising generation of millennial patients finds providers.

Millennials were twice as likely as boomers to trust reviews on healthcare specialty sites over word of mouth – and 75 percent more likely to trust patient reviews on Google over primary care physician referrals.3

These are striking results. The growth market in healthcare – the millennial generation – considers crowdsourced opinion on the web less biased than word of mouth or referrals from domain experts.

These are striking results. The growth market in healthcare – the millennial generation – considers crowdsourced opinion on the web less biased than word of mouth or referrals from domain experts.

The consequence is clear: You can’t market healthcare to the largest and fastest growing segment of the market without social proof on the web.

2. Competing for Patients on the Web

Healthcare brands are no longer controlled by marketers. Patient feedback about doctors and facilities online is leading to total market transparency for healthcare consumers. CG-CAHPS surveys only go so far in providing social proof.

You’re Not in Control

There was a time when marketers with adequate cash controlled their brands.

But now, in the always-on digital world of virtually perfect and handheld information, healthcare marketers have begun falling into one of two camps: those who positive co-create their brands with consumers online, and those whose brands are being co-opted by the public.

The Market is Transparent

In the market for visits and admissions, patient experience is a currency that’s being traded between consumers online 24/7, in a digital exchange of perfectly transparent (if not factually perfect) information about doctors and facilities.

In the market for visits and admissions, patient experience is a currency that’s being traded between consumers online 24/7, in a digital exchange of perfectly transparent (if not factually perfect) information about doctors and facilities.

Fully 84 percent of millennials don’t trust advertising.4 They have far more confidence in crowdsourced opinion on the web.

In such an environment, every healthcare marketer now must actively compete for mindshare on review sites. They have become critical channels to reach patients who might otherwise not have found your providers or facilities at all.

Online Reviews: Escalating Importance

Many practices, systems and providers are skeptical about the importance of online reviews in guiding consumer decision-making. In 2013, Pew Research reported that only 17 percent of adults consulted online reviews about doctors.4

More recent research, however, indicates a shift. A 2015 survey of U.S. consumers found that 42 percent (averaged across all age groups) read and trust online patient reviews.5

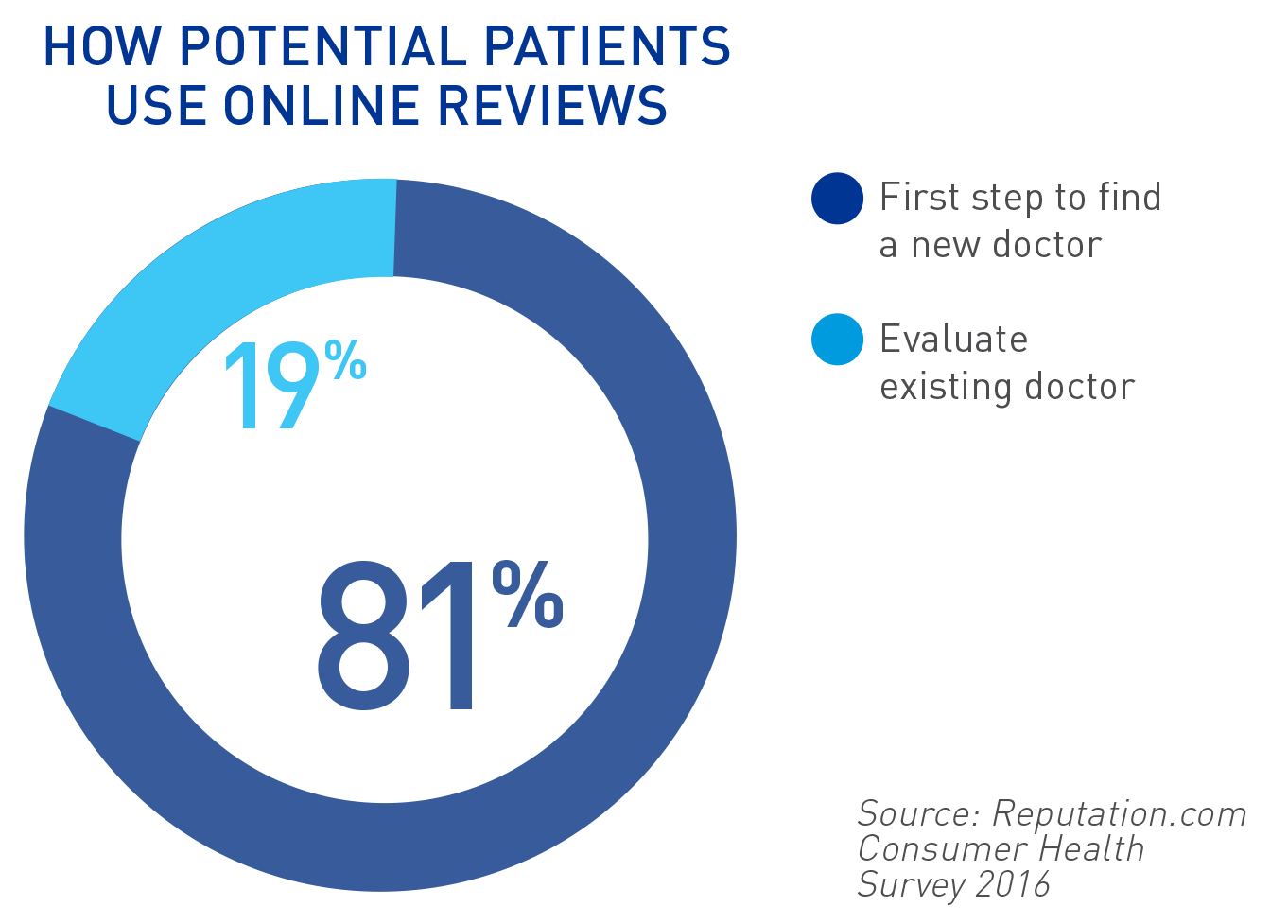

And a 2016 study by Reputation.com showed that over 80 percent of prospective patients in the U.S. now use search (where star ratings are displayed prominently) and online reviews as a first step to find and validate their selection of a new doctor.

CG-CAHPS: Necessary but not Sufficient

Many healthcare organizations consider CAHPS and Patient Experience surveys adequate for capturing and showcasing feedback on practitioners. They understand that results can be published (in compliance with HIPAA regulations) on physician and facility web pages, delivering a significant boost to search engine page rankings.

But relying on CAHPS data alone is no longer enough. Consumers, particularly millennials, seek out opinions on healthcare specialty sites — and increasingly, Google and Facebook.

To rank highly on these destinations and perform in SEO, marketers must solicit, capture and stream both CAHPS survey results and online reviews to practitioner web pages. Online reviews also provide actionable patient experience data to help improve operations that CG-CAHPS surveys may miss.

3. To attract new patients, brands must become hyper-local

In the search for providers, all branding is local – at the level of individual physicians and facilities. Managing proliferating points of social presence on the web requires technology to scale. But healthcare marketers who grow online review volume and quality will be rewarded with higher search visibility.

Online, every patient has the microphone. So instead of managing the message oneway, through one-to-many mass media, marketing must now develop messages onewith- many, hyper-locally.

Online, every patient has the microphone. So instead of managing the message oneway, through one-to-many mass media, marketing must now develop messages onewith- many, hyper-locally.

In this new world, the high-impact brands that marketers need to develop are those of individual physicians – at the location level.

For proof, just pick up your Apple or Android smartphone. Search for a physician, clinic or hospital near you. Your options will show up as either:

[widgetkit id=”269″]

Healthcare marketers can no longer buy brand equity. It must be co-created with consumers online, where local search, mapping and review sites have become critical gateways for patients to find doctors and facilities.

Healthcare marketers can no longer buy brand equity. It must be co-created with consumers online, where local search, mapping and review sites have become critical gateways for patients to find doctors and facilities.

And from that first results screen, through business listings detail, through posts on review sites and social media sites – you’ll see that star ratings and reviews for individual practitioners and locations are inescapable.

A Battle on Thousands of Fronts

Further adding to the challenge, healthcare marketers must compete on thousands of fronts at once.

The math is as simple as it is daunting: Multiply your number of practitioners by the number of review and listing sites where they appear on the web. That’s how many points of presence you now need to manage to attract healthcare consumers.

The data proves this out. Our team of data scientists went to work analyzing the impact of online reviews on healthcare providers’ search engine visibility.

The data shows that four factors drive page performance:

- Review volume – how many reviews a practitioner or facility receives

- Review recency – the freshness of online reviews

- Review length – the word count in patients’ reviews

- Review sentiment – the number of stars patients gave them

The more reviews practitioners or facilities get – and the more recent, detailed and positive those reviews are – the higher their search rankings, and the more likely new patients are to find them.

Online Reviews Drive Search Rank

Number of Reviews

This impact here is significant: The first 10 reviews can boost ranking from the search engine netherworld to page one. And just 50 reviews can increase expected click through rate by 266 percent.7

Patients are far more likely to see and choose your providers when they have a large number of reviews

“A location’s first 10 online reviews can boost it from the search engine netherworld to the top half of the first page.”

4. Focus on the Review Sites That Matter Most

To ensure prospective patients find your providers, it’s important to generate reviews on sites with the greatest impact on search results.

The Reputation.com Data Science platform continuously evaluates healthcare review sites and classifies them into priority tiers based on factors that include their impact on local search rank, traffic, authority, and volume of reviews.

Based on the most current findings, your team should first focus on generating reviews on Healthgrades and Google Places to gain the biggest initial return. Facebook should be included in the next tier of priorities, followed by Zocdoc (primarily in the New York region), Yellow Pages, Yahoo Local, and Vitals.com. Of lesser significance, and still relevant to a number of niche specialties, are UCompareHealth, RateMD, Wellness and WebMD.

A Three-Step Cycle

A good online reputation management platform helps distribute reviews efficiently across the spectrum of review sites to establish presence and visibility. This is an ongoing effort, and sites should be kept fresh with new, recent reviews.

It’s imperative to generate more, recent reviews on top tier sites and dynamically adjust where to send patients to write reviews accordingly. This dynamic optimization makes the most noticeable difference in attracting new patients.

5. Business Implications

Online ratings and reviews stand between everything a healthcare organization spends on marketing and its revenue performance.

The moment that a potential patient sees a star rating is a ground-zero, digital moment of truth in her search for a provider. It determines where she seeks care, and whether your facility gets the new visit and the lifetime value of that patient.

Online ratings and reviews are the gate search results, visibility, visits and admissions. Whatever a marketing leader is spending in paid and owned media of all kinds — advertising in print, outdoor media, radio, television, on the web, SEO, SEM and social media — goes up in smoke when a potential patient is confronted with mediocre reviews. To rank highly on these destinations — and perform in SEO — marketers must combine both CAHPS and online review data.

Practitioners’ and locations’ online reputations are critical competitive elements that must be carefully developed and managed, to help patients decide in your favor:

Reputation Stands Between Marketing Spend and New Patients

6. A Plan for Action

for leading healthcare organizations.

To encourage patient engagement and turn them into digital advocates who help drive admissions, recurring visits and revenue, best-in-class healthcare marketing leaders are deploying technology to:

- Establish accurate presence and business listings with all major directory and review sites, particularly Google.

- Monitor and respond to reviews on major third party review sites

- Solicit direct reviews from patients to establish a clear and candid baseline

- Publish direct reviews and ratings on your website to improve your SEO rank and drive more visitors

- Ask patients to write reviews on major 3rd party review sites to ensure they provide a representative and consistent picture of your patients’ experience

1 United States Census Bureau 2016

2 Reputation.com Consumer Healthcare Survey 2016 (n=1,500)

3 McCarthy Group and Google Consumer Surveys 2014

4 National Research Corporation, 2015 Digital Decision Maker Study (n=3,002)

5 Reputation.com Consumer Healthcare Survey 2016 (n=1,500)

6 Reputation.com