Under The Microscope: Patient Experience in Private Healthcare

Reputation Staff Writer

The Reputation Data Science team analysed thousands of patient reviews across 171 private hospitals in the U.K. on Google, NHS and review sites like ‘I want great care’. We ranked the biggest private hospitals using our proprietary Reputation Score during a year rocked by a global pandemic. We found that:

- Review volume has tripled over the last 5 years. The trend continues with as many reviews in 2020 as 2019 despite the pandemics causing hospitals to shut down most of their operations.

- Cleanliness and bedside manners are what drive the most positive sentiment in patient reviews. Whereas billing and surprisingly waiting time are driving the most negative reviews showing where the sector needs to improve their reputation.

- The response rate to review from private hospitals has been historically lower than in other industries. However, we’ve seen a huge improvement, with an average response rate reaching up to 68% in 2021.

- Reviews make a huge difference in building a strong reputation overall. The healthcare groups with the highest Reputation Scores accumulate twice more reviews than laggards and respond 5 times more to their reviews.

These are indicators that the digital transformation in healthcare is accelerating. Engaging with patients online, for example, through online reviews, is one of the many ways a healthcare provider could enhance their reputation and ultimately increase patient acquisition and market share.

Download our ‘Quick Take’ version of this report in handy PDF format via the button below.

The State of the Private Healthcare Industry

In 2019, 11% of the United Kingdom’s population – almost 4 million people – opted for Private Medical Insurance (PMI), despite the availability of ‘free at the point of access’ healthcare through the National Health Service (NHS).

Now, with the burgeoning NHS backlog, the future for private health care in the UK looks evermore positive as the industry looks set to register a Compound Annual Growth Rate (CAGR) of 5.05% during the period 2021-2026.

Challenges and Opportunities Ahead

The post-pandemic era and the NHS waiting list crisis is generating new opportunities for the private healthcare industry.

Patient Backlog

Lewis Cone, Senior B2B Analyst, predicted in 2020 that the UK would see “a rebound in the private healthcare market as the backlog of treatments and surgeries not carried out in light of the pandemic will be rescheduled and spill over into future months.”

Cone’s predictions are coming to fruition in 2022 as the market for private healthcare services in the UK is expected to reach $13.8 billion by 2025.

Public Sector Referrals

In terms of winning patients, the private healthcare sector looks set to benefit from referrals from the public sector as the NHS drives patients towards private facilities to ease their waiting lists.

A recent survey of 4,000 UK patients indicated that more than 20% of these opted for private healthcare to get treatment rather than wait for NHS care.

Cost of Living

Despite the numerous opportunities for the private healthcare sector, the industry will need to adapt to the squeeze on people’s incomes amidst a rise in the cost of living. With households looking to cut back on expenditure, healthcare companies will have to create compelling cases to convince people to part with their money for private treatments.

Safety & Trust

Data shows that 58% of Britons are yet to use any private healthcare service, and with the public continuing to hold the NHS in high regard, healthcare companies have their work cut out in 2022 when it comes to winning consumer trust.

Convincing patients of safety is a significant hurdle on the private healthcare sector’s path to growth.

According to the Care Quality Commission (CQC), 40% of private hospitals failed patient safety standards in 2018. Thus, consumer confidence is perhaps low, and this may have been aggravated by Covid-19 anxiety.

However, healthcare companies that can demonstrate excellence in all aspects of patient care and safety standards are standing out from the crowd as Reputation’s analysis highlights, and these groups are poised to win the lion’s share of the market.

What Does The Data Reveal?

To find out, the Reputation Data Science team examined 8,500 patient ratings/reviews across providers’ websites and social media pages. We used our own proprietary data analysis methodology that uses natural language processing to detect patterns in patient comments. Here’s what we found:

Review Volumes Are Constantly Growing

Across most industries in the UK, review volume boomed in 2016 as large web players like Google and Facebook focussed on third party unstructured data to fuel their algorithms. Google is a trust engine, and genuine consumer reviews are increasingly important as a factor of Google’s local search ranking.

Consumers followed suit with reading reviews before making purchase decisions, now over 80%, and trusting them as much as friends and family. Healthcare, and private healthcare especially, are not immune to this consumer behaviour, which is not going to change based on the recent study aforementioned about millennials’ purchase behaviour.

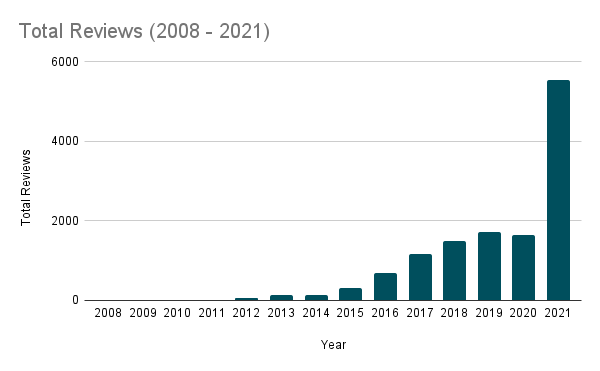

Across the 171 analysed locations, we saw a dramatic rise in review volumes. From 2016 to 2021, volumes tripled for the private sector on Google. Since February 2021, review volumes have tripled again signifying considerable industry growth and the willingness of private healthcare patients to leave feedback online.

Review volumes for the private healthcare sector skyrocketed in 2021.

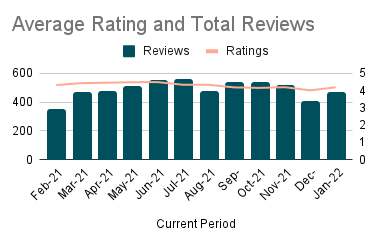

In contrast to 2020 when Google paused reviews for healthcare providers for a time, 2021 has seen the industry receive a high and steady number of reviews. Meanwhile, ratings remained generally high with the majority being over 4 stars.

Throughout 2021, patient reviews were left in record numbers while ratings remained high.

The influx of patient reviews represents a golden opportunity for healthcare providers. As patients go online for recommendations, private hospitals need to build trust with new patients through their online reputations. Reviews, as one aspect of online reputation, are the social proof consumers trust, and hospitals have an opportunity to open a dialogue in this online forum, engaging with existing patients while driving new patient acquisition.

Find out more about how reviews are directly correlating to local search ranking here.

Responding to Reviews

The influx of patient reviews represents a golden opportunity for healthcare providers. As patients go online for recommendations, private hospitals need to build trust with new patients through their online reputations. Reviews, as one aspect of online reputation, are the social proof consumers trust, and hospitals have an opportunity to open a dialogue in this online forum, engaging with existing patients while driving new patient acquisition.

Now, with review volumes exploding, private hospitals are taking action and this is evident in our healthcare provider rankings with the top two companies surpassing the industry average by quite a margin. However, there remains a large number of hospitals failing to respond to reviews at all.

With an industry average of 59%, only 2 out of the big 5 groups show a response rate over 70%. Hospitals that are currently not responding to reviews regularly could take advantage of their competitors’ slow or non-existent review response rates.

2 out of the big 5 groups show a response rate of over 70%.

Covid-Related Reviews Are Declining

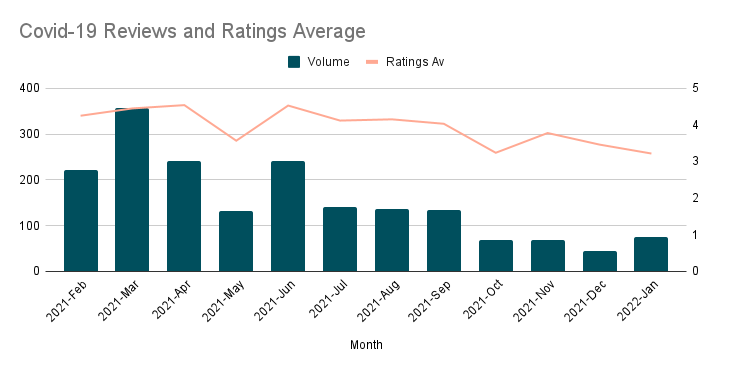

As the UK enters a post-pandemic period and a long-awaited return to normalcy, Reputation found that reviews, where Covid-19 is mentioned, are becoming less frequent. However, when Covid-19 (or related phrases) appear in patient reviews, it tends to be in a much more negative way.

Covid is being mentioned less frequently within patient reviews.

“Tried to attend my appointment today and was turned away at the door because I had my three month old baby with me. The receptionist said it was because of covid and expected me to be able to find childcare in the ten minutes before my appointment started.”

Cleanliness and Bedside Manner are the biggest drivers of positive sentiment

Patients clearly value medical professionals that demonstrate a good bedside manner. Thus, feedback relating to the interpersonal interactions between a doctor and patient (treatment with respect, explaining clearly) and the overall cleanliness of a location continues to be among the most positive categories we analysed from all online reviews. These are important factors especially for self-pay patients when choosing a private healthcare provider.

My 5 year old son had surgery here and the staff all made him feel so comfortable and safe. Nicola and Bina looked after him so well. The jelly, ice cream and sticker certificate was a real treat and he was a very happy boy. From a parent’s point of view it is just such a relief to have your child looked after so well when you are anxious about the procedure. I myself had lunch and it was delicious – lots of choice and healthy with seabass and fresh fruit salad. The room was en-suite with a lovely view to the forest. It was spacious and so clean. Excellent overall experience. Thank you.

Less common in reviews but highly positive are mentions of ‘food quality’. The quality of food for patients is another differentiator in which private hospitals must invest to enhance the overall patient experience.

Waiting Time and Affordability are the biggest drivers of negative sentiment

Shorter waiting times are one of the main reasons why patients choose private healthcare over NHS treatment. However, ‘waiting time’ is a source of negative sentiment in online reviews of private hospitals. Private healthcare companies must ensure waiting times are kept to a minimum and urgently address negative online reviews by responding in a timely, professional manner to capitalise on the patient backlog in 2022.

“I was told in May that I would require an operation and I wouldn’t have a long wait. I have been chasing a date for the last four months and tend to be kept on the phones for over 30 minutes without answer. I keep being told contact would be made soon but never hear anything. I expected a better service with it being a private hospital.”

Providing value-for-money for patients should be a focus for private healthcare companies and private hospitals. Offering a great patient experience generally justifies the price range but we also found out that issues around ‘billing’ are often the underlying cause behind the negative sentiment around affordability. Private hospitals must strive to ensure robust and transparent billing systems to deliver the best possible patient experience.

“…pricing advised over the phone and it worked out at £1500 for consultation, ultrasound and biopsy of breast lump. Paid £250 charge upfront for the consultation. Disgusted to receive an invoice today for £1857, not even taking into account the money already paid, a lot of hidden charges on this invoice that at no point was I the payer of this healthcare or the patient made aware of. Avoid at all costs. Will be contesting this invoice and taking to court if required.”

‘Staff’ receives the most mentions in positive and negative contexts

Online reviews mentioning staff are by far the most frequent in both positive and negative contexts. Along with providing high standard facilities, well-trained and caring employees is a huge differentiating factor for private hospitals to continue to nurture and highlight as they seek to win patients amidst NHS backlogs.

“Having knee replaced next week everyone have been so kind and so thorough..The physio lady was amazing and gave me excellant advice for after my operation i feel alot more relaxed about it now ..Update had knee replaced what a fantastic team..All staff just lovely the care is amazing food lovely..I would use this hospital again with no worrys..A HUGE MASSIVE THANKYOU EVERYONE.”

Top Private Hospitals Ranking

We ranked the top 5 largest private healthcare groups using our proprietary Reputation Score¹. To arrive at a healthcare group’s Reputation Score, we evaluated acute care hospitals within each healthcare group and aggregated their scores.

| Reputation Score | Sentiment | Visibility | Engagement | ||

| 1 | BMI | 629 | 70.00% | 63.33% | 85.00% |

| 2 | Ramsay | 504 | 56.00% | 51.00% | 74.00% |

| 3 | Nuffield | 496 | 56.00% | 53.67% | 33.00% |

| 4 | HCA | 486 | 56.00% | 60.00% | 42.00% |

| 5 | Spire | 452 | 48.00% | 54.67% | 31.00% |

¹Based on publicly reported revenues as of 1st March 2022

What does it take to be a top healthcare brand?

When we examined Reputation Scores for patterns in performance, we found that:

- Leaders (the top performers) outperformed laggards (the bottom performers) in sentiment, visibility, and engagement.

- Sentiment is especially important because of all the elements of Reputation Score, sentiment has the biggest impact. Top-ranked BMI had the highest star average score, 70% (up 4% from last year).

- The biggest difference between leaders and laggards: engagement. Leaders engage more with their customers and respond to reviews much better than laggards do.

To win new patients and deliver an enhanced patient experience, private hospitals must:

- Be responsive to online queries and comments from patients

- Understand and act upon sentiment trends within patient reviews to drive operational improvements

Get Started

Undertaking digital transformation in your company can seem overwhelming but don’t fret – our Reputation Experience Management (RXM) Guide is here to help professionals in the healthcare industry.

Access the guide to gain insight into the actions you can take today to enhance your brand’s online reputation and patient experience to boost business performance overall.